Drax Power Limited owns and operates Drax Power Station, the largest, cleanest and most efficient coal-fired power station in the UK.

Drax Power Limited owns and operates Drax Power Station, the largest, cleanest and most efficient coal-fired power station in the UK.

The generating units are fitted with flue gas desulphurisation (FGD) equipment removing 90% of SO2 from emissions, and work is underway to reduce still further emissions of oxides of nitrogen (NOX).

The plant is experimenting with bio fuels (willow chips) and petcoke which is a recovery from oil refining.

By-products of the coal combustion and FGD processes are recycled through their further use in the construction industry.The plant output 4,000 megawatts, 7% of the UK's electricity needs.

Drax Group Limited

…is Incorporated in the Cayman Islands Co No WK-129356

Registered Office

Walkers SPV Limited

Walker House

PO Box 908GT

Mary Street

George Town

Grand Cayman

Cayman Islands

British West Indies

Today the company announced someone wanted to buy them…and the plant which is a core component of the UK energy supply. …

Drax Group Limited ("Drax") today announces that it received on 10 October 2005 a new approach from a consortium regarding a possible cash offer for Drax. The proposal is subject to a number of conditions, including due diligence and financing, and is an alternative to the listing. Drax is seeking further clarification on the initial approach...

It was only a few weeks ago that someone else wanted to buy them ..

The Board of Drax Group Limited ("Drax" or "the Company") announces that it received on 12 September an indicative approach from a consortium comprising Constellation Energy Group, Inc and Perry Capital LLC regarding a possible cash offer for Drax representing an enterprise value of £1.9 billion. The proposal is subject to a number of conditions, including due diligence and financing...

But the Directors turned the offer down.

So how is it that a shadowy group of investors, located in the Cayman Islands have become a much wanted asset ?

Briefly, In 1990, the electricity industry of England and Wales was privatised under the Electricity Act 1989. Three generating companies and 12 regional electricity companies were created. As a result of privatisation, Drax Power Station came under the ownership of National Power, one of the newly formed generating companies.

Due to changes in the structure of the market , needs for cash, a change in strategy in 1999 Drax Power Station was acquired by the US-based AES Corporation (A Delaware based outfit) for £1.87 billion. Of course it wasn’t their money, they borrowed it and so they ended up with a raft of creditors, which when things went sour they couldn’t pay.

So they “

restructured” the debt , which meant the “D” level guys were toasted but the “A” level creditors , some of whom like mining giant BHP Billiton were supplying the plant with coal.

Following a series of standstill agreements with its creditors, the AES Corporation and Drax parted company in August 2003. Just months later in December 2003, creditors overwhelmingly supported a financial restructuring scheme that put Drax into the ownership of a number of financial institutions.

On December 22, 2003,

The Debevoise & Plimpton partnership (fancy US corporate lawyers) could announce, after drawing monster fees, that Drax Power, Europe’s largest coal-fired power station, had successfully restructured its ₤1.3 billion senior secured debt. Debevoise & Plimpton LLP represented Drax Power in this transaction.(Once owned by the British Public)

The successful restructuring puts Drax, which supplies 8-10% of Britain’s power, in a strong financial position going forward. The refinancing involved concurrent schemes of arrangement in England, Jersey and the Cayman Islands, and a Section 304 bankruptcy court proceeding in the United States.

The BBC reported that there were four bids considered for re-structuring which took the form of complex offers to buy out portions of the plant's debt.

BHP Billiton's offer, worth an estimated £95m, would see holders of Drax's A-2 debt get 70p in the pound. International Power another energy company offered 65p in the pound for A-2 debt and 55p in the pound for B debt. Goldman Sachs the bankers were offering 64p in the pound for A-2 debt and 50p in the pound for B debt.

Money market men said that the deal was finally agreed at what represented approximately 70p per pound of debt. In brief they bought £1.34 Bn of assets at a discount of 30% = £ 938 Mn (give or take a few bob).

Since taking over ownership effectively from Jan 1st 2004, the company has seen the price of wholesale electricity climb from £24 per Megawatt Hour to £48 MWH, which is the good news, the bad news is the price of coal has gone from under £10 a ton to £25 a ton. However the owners have seen for example Nett profits for the first 6 months of 2005 at £227 Mn and interest has been paid at the rate of £160Mn per year (mainly to the owners) who bought that debt. (Caveat - the £227Mn profit includes one off payments from TXU Europe whose bankruptcy caused AES to founder – but this was factored into the buying price because it was problematic at the time and required an Act of Parliament to change the rules so they could get the money).

So not exactly a wild cash cow, but has been a nice little earner that Debevoise & Plimpton partnership and (Morgan Stanley hovering in the background) put together…and now someone else wants to have a share of the action.

So that’s OK for the UK ?

Well up to a point Lord Copper.

Drax has contracts for coal with

UK Coal, (the rump of the NCB after Maggie destroyed it) who are the biggest UK (in fact only) coal miner. Figures for the year ended December 2004 showed pre-tax losses deepened to £51.6 million, from a loss of £1.2m in 2003. Deep-mine output dropped from 14.8 MN tonnes in 2003 to to 12.0 million while surface mine output was down from 3.1 Mn tonnes to 2 MN.

When posting half-year losses of £30.6m, UK Coal warned attempts to support further development at Rossington had failed and that the mine would be mothballed – the same fate as Harworth mine once current extraction is completed.

Their shares up from a low of the mid 40’s pence in early 2003 have moved sideways at 140/145 p for nearly 12 months, bn 3200Mn of that is surface property and landholdings, the last asset of the old NCB.

Now Tom Farmer famous for his Kwit Fit chain is said to want to buy the property portfolio and there is talk of an offer of 180p – 200p per share. Farmer is working with Alchemy Partners who lost out on MG and also the bachelor Lord Buccleuch, the only landownder in Scotland whose estates are so large you cannot ride across them on a dhorse in a day.

The shares haven’t moved, principally because nobody wants to run mines that lose £36Mn in 6 months.

Which is why the figures for coal imports into the UK make such interesting reading. In 2004, Coal imports increased by 20 % - a new record level. 72% of the United Kingdom’s imports of coal came from just three countries: South Africa, Australia and Russia. A further one fifth of coal imports came from three additional countries, Colombia (steam coal), USA (mainly coking coal) and Indonesia (steam coal).

Steam coal imports came mainly from South Africa (34 %), Russia (33%) and Colombia (12 %). Imports of steam coal from the USA were substantially higher in 2004 than 2003, accounting for 2.4 per cent of the total in 2004 compared with less than 0.1 per cent of the total in 2003. Imports of steam coal from South Africa in 2004 were more than double the volume imported in 2000. All but a very small fraction of UK coking coal imports came from Australia (65 %), the USA (21 %) and Canada (11 %).

So this is where our with the wonderful far sighted New Labour White Paper Energy policy.

An irreplaceable national source of electricity, owned by a bunch of financiers operating out of a nameplate in the Cayman Islands.

A company being stalked by the funny money men.who have no interest in UK energy independence.

This company relies upon a company mining coal which is evident cannot carry on mining / trading, (even if Tom Farmer rides in and picks up their property assets)

....... Unless of course the Government see that they can add some more subsidies to the pot – and there have been plenty in the last few years, disguised in a variety of ways.

Suddenly nuclear power stations look like a good idea.(if not the only)

Recent blogs on same topic

here

His last bout was with his protègè turned-rival Tommy Gunn in Rocky V, now Sylvester Stallone (60 !) who earned $15,000 from his first fillum is due for another $10Mn payday with Rocky V1, 30 years after first putting on the gloves.

His last bout was with his protègè turned-rival Tommy Gunn in Rocky V, now Sylvester Stallone (60 !) who earned $15,000 from his first fillum is due for another $10Mn payday with Rocky V1, 30 years after first putting on the gloves.

It is also evident now that the whole thing was even rehearsed – by no less than a Allison Barber, deputy assistant Defense secretary, see pic.

It is also evident now that the whole thing was even rehearsed – by no less than a Allison Barber, deputy assistant Defense secretary, see pic. Less than 40 percent in an AP-Ipsos poll taken in October said they approved of the way Bush was handling Iraq. Just over half of the public now say the Iraq war was a mistake.

Less than 40 percent in an AP-Ipsos poll taken in October said they approved of the way Bush was handling Iraq. Just over half of the public now say the Iraq war was a mistake. Canons roared across public parks, and fires swept across Denmark today – has Prime Minister Anders Fogh Rasmussen announced withdrawal of Danish troops from Iraq, as 69% of Danes have demanded in a recent poll ?

Canons roared across public parks, and fires swept across Denmark today – has Prime Minister Anders Fogh Rasmussen announced withdrawal of Danish troops from Iraq, as 69% of Danes have demanded in a recent poll ? In a July 28th television interview with Jim Lehrer, U.S. Secretary of State Condoleezza Rice ....

In a July 28th television interview with Jim Lehrer, U.S. Secretary of State Condoleezza Rice ....

This is the war memorial erected in my village after the First World War. Already descendants of the "Lions led by Donkeys" have been laying memorial Poppy wreaths.

This is the war memorial erected in my village after the First World War. Already descendants of the "Lions led by Donkeys" have been laying memorial Poppy wreaths.

China has successfully launched its

China has successfully launched its  China's budget for developing the Shenzhou capsule series has reached roughly 19 billion yuan (US$2.3 billion), less than 10% of the United States' annual spending on space programs

China's budget for developing the Shenzhou capsule series has reached roughly 19 billion yuan (US$2.3 billion), less than 10% of the United States' annual spending on space programs David Freeman, pioneer of computer retailing, is selling, founder of ACP Superstore, has been collecting computers since 1976. H eis selling over 430 Pc's including this historic 32K Ram Z - 80 PET ,40 printers..etc., etc.,are for sale on

David Freeman, pioneer of computer retailing, is selling, founder of ACP Superstore, has been collecting computers since 1976. H eis selling over 430 Pc's including this historic 32K Ram Z - 80 PET ,40 printers..etc., etc.,are for sale on  On the 6th of October 2005 Andy Hayman, QPM,MA Assistant Commander, Special Operations , New Scotland Yard wrote to Rt.Hon. Charles Clarke, the burly, bluff Home Secretary ;

On the 6th of October 2005 Andy Hayman, QPM,MA Assistant Commander, Special Operations , New Scotland Yard wrote to Rt.Hon. Charles Clarke, the burly, bluff Home Secretary ;

This is Licio Gelli pictured (

This is Licio Gelli pictured (

The last time Condi was in Pakistan was in March this year. She had stopped off to seal a US$3Bn arms deal and to release sixteen F16 fighters that Pakistan bought and paid for in 1990, that the US never delivered .... so what’s US$50Mn between friends ?

The last time Condi was in Pakistan was in March this year. She had stopped off to seal a US$3Bn arms deal and to release sixteen F16 fighters that Pakistan bought and paid for in 1990, that the US never delivered .... so what’s US$50Mn between friends ?

Denmark's economy is booming. New growth figures from Statistics Denmark, shows economic growth is at its highest level in a decade led by sales of purchases of clothes, cars, and home and recreational products.

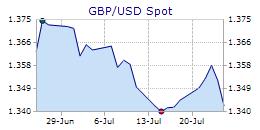

Denmark's economy is booming. New growth figures from Statistics Denmark, shows economic growth is at its highest level in a decade led by sales of purchases of clothes, cars, and home and recreational products. UK trade in oil plummeted from a surplus of £40m in July to a deficit of £413m in August - Oil exports slumped from £1.84bn in July to £1.59bn in August – reflecting the decline in oil and gas extraction during the month of August of 8%. Imports of oil ratcheted up again from £1.8bn to £2bn. The US$/£ rate shows how the market reacted.

UK trade in oil plummeted from a surplus of £40m in July to a deficit of £413m in August - Oil exports slumped from £1.84bn in July to £1.59bn in August – reflecting the decline in oil and gas extraction during the month of August of 8%. Imports of oil ratcheted up again from £1.8bn to £2bn. The US$/£ rate shows how the market reacted. The Danish retailers organisation Dansk Handel & Service (DG&S), says more than half of its members have had a better year this year than last. 'The growth rate is a result of the marked growth at the end of 2004, which was especially strong for durable goods,' said DH&S chief economist Jan Poulsen. 'Private spending continues on a reasonable track. If anything should endanger the sustainability of growth, it would be a lack of workers.'

The Danish retailers organisation Dansk Handel & Service (DG&S), says more than half of its members have had a better year this year than last. 'The growth rate is a result of the marked growth at the end of 2004, which was especially strong for durable goods,' said DH&S chief economist Jan Poulsen. 'Private spending continues on a reasonable track. If anything should endanger the sustainability of growth, it would be a lack of workers.' Which is reflected in a report from the Ministry of Science, Technology, and Innovation found that 60 % of foreign students were still in Denmark one year after they received their degree. The national daily Berlingske Tidende reports that young people who come to Denmark to study for advanced degrees in engineering, medicine, and theology wind up liking the country so much that they end up staying.

Which is reflected in a report from the Ministry of Science, Technology, and Innovation found that 60 % of foreign students were still in Denmark one year after they received their degree. The national daily Berlingske Tidende reports that young people who come to Denmark to study for advanced degrees in engineering, medicine, and theology wind up liking the country so much that they end up staying.

So the UK imports potato pickers for the fields and order pickers for the gleaming new warehouses and distribution centres stuffed full of goods from low cost countries, whilst Denmark imports the brightest and best technicians, engineers and scientists.

So the UK imports potato pickers for the fields and order pickers for the gleaming new warehouses and distribution centres stuffed full of goods from low cost countries, whilst Denmark imports the brightest and best technicians, engineers and scientists.

Drax Power Limited owns and operates Drax Power Station, the largest, cleanest and most efficient coal-fired power station in the UK.

Drax Power Limited owns and operates Drax Power Station, the largest, cleanest and most efficient coal-fired power station in the UK. On December 22, 2003,

On December 22, 2003,  Portugal is one of the few places in European family of nations which still bans abortions. Portuguese Prime Minister José(Zé) Socrates' decision to hold a referendum on legalising abortion, approved by Parliament will probably be held in mid-November and will probably bring in changes more in line with her partners in the EU. Although in 1984 the law was changed to allow abortion in certain exceptional circumstances such as risk of danger to the life or health of the mother, a malformed foetus or rape, women still face up to 3 years in prison for procuring an abortion or more for performing one.

Portugal is one of the few places in European family of nations which still bans abortions. Portuguese Prime Minister José(Zé) Socrates' decision to hold a referendum on legalising abortion, approved by Parliament will probably be held in mid-November and will probably bring in changes more in line with her partners in the EU. Although in 1984 the law was changed to allow abortion in certain exceptional circumstances such as risk of danger to the life or health of the mother, a malformed foetus or rape, women still face up to 3 years in prison for procuring an abortion or more for performing one. The number of backstreet abortions annually in Portugal is estimated at between about 20,000 and 40,000, while thousands more go abroad to terminate unwanted pregnancies under different legal jurisdictions. and Figures from the Portuguese health ministry say five women died last year after secret abortions.

The number of backstreet abortions annually in Portugal is estimated at between about 20,000 and 40,000, while thousands more go abroad to terminate unwanted pregnancies under different legal jurisdictions. and Figures from the Portuguese health ministry say five women died last year after secret abortions. In July 2005 , the

In July 2005 , the  Concerned about national energy security, as supplies of natural gas are set both to soar and arrive on these shores from Russia by pipeline and the Middle East by boat to as yet unbuilt LNG ports,

Concerned about national energy security, as supplies of natural gas are set both to soar and arrive on these shores from Russia by pipeline and the Middle East by boat to as yet unbuilt LNG ports,  The Association of Electricity Producers, which speaks for E.On, RWE and EDF, confirmed it had a formal meeting with Energy Minister Malcolm Wicks in July. It is reported that they told Wicks:

The Association of Electricity Producers, which speaks for E.On, RWE and EDF, confirmed it had a formal meeting with Energy Minister Malcolm Wicks in July. It is reported that they told Wicks:  British Energy, operator of the country's current 8 nuclear power stations, cannot build any new capacity due to EU regulation as a result of receiving state aid in their re-structuring. British Energy now financially re-engineered (the shares have doubled in the last 12 months) announced in early September that Dungeness (which took 18 years to build after a series of massive and hugely expensive cock-ups) will be kept open until 2018 which would allow it to continue making a "powerful contribution" to the UK's energy needs and would safeguard hundreds of jobs. It insisted the decision would not pave the way for further extensions at its other UK nuclear power stations. British Energy have successively extended the useful life of their plants (which collectively only operate at 75% load) beyond their initial design life.

British Energy, operator of the country's current 8 nuclear power stations, cannot build any new capacity due to EU regulation as a result of receiving state aid in their re-structuring. British Energy now financially re-engineered (the shares have doubled in the last 12 months) announced in early September that Dungeness (which took 18 years to build after a series of massive and hugely expensive cock-ups) will be kept open until 2018 which would allow it to continue making a "powerful contribution" to the UK's energy needs and would safeguard hundreds of jobs. It insisted the decision would not pave the way for further extensions at its other UK nuclear power stations. British Energy have successively extended the useful life of their plants (which collectively only operate at 75% load) beyond their initial design life.

On January 31st Tony Blair was in Manchester, UK and in answer to a reader of the Manchester Evening News, judged it an appropriate time to discuss nuclear power in public. The answer was

On January 31st Tony Blair was in Manchester, UK and in answer to a reader of the Manchester Evening News, judged it an appropriate time to discuss nuclear power in public. The answer was

The three-seater (!) car is packed with “user-friendly technology”, 1. Nissan's Around View Monitor cuts blind spots by displaying the outside surroundings on LCD colour screens mounted either side of the windshield. No fuddy duddy old mirrors then. 2. A dash-mounted infrared (IR) commander allows the driver to operate the navigation and stereo systems with simple finger movements without letting go of the steering wheel. Whooooop de dooooo!!!. Finger controls !

The three-seater (!) car is packed with “user-friendly technology”, 1. Nissan's Around View Monitor cuts blind spots by displaying the outside surroundings on LCD colour screens mounted either side of the windshield. No fuddy duddy old mirrors then. 2. A dash-mounted infrared (IR) commander allows the driver to operate the navigation and stereo systems with simple finger movements without letting go of the steering wheel. Whooooop de dooooo!!!. Finger controls !

Staff Sergeant,

Staff Sergeant,  32 year old Lumber saleswoman Lorrie Heasley of Woodland, Wash., was returning with her husband from Disneyland on a SouthWest Airlines LA – Portland ,Ore and the flight was on stopover at Reno-Tahoe International Airport, halfway through Heasley's scheduled trip from Los Angeles to Portland, Ore.

32 year old Lumber saleswoman Lorrie Heasley of Woodland, Wash., was returning with her husband from Disneyland on a SouthWest Airlines LA – Portland ,Ore and the flight was on stopover at Reno-Tahoe International Airport, halfway through Heasley's scheduled trip from Los Angeles to Portland, Ore.