The Mysterious case of the disappearing M3

"The last duty of a central banker is to tell the public the truth."-- Alan Blinder, Vice Chairman of the Federal Reserve, on PBS’s Nightly Business Report in 1994.

Your New Year Cut out 'N' Keep New year supplement for 2007

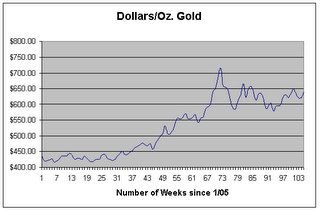

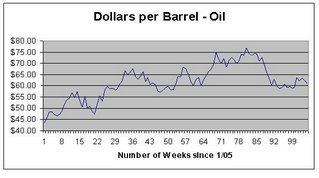

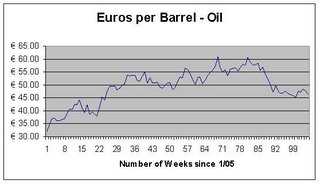

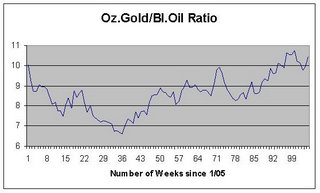

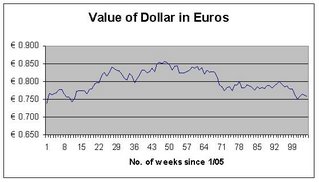

Here are some charts stolen from the always excellent Signs of the Economic Apocalypse (SEA) which show (briefly) that in 2006 gold rose in price whether paid for in dollars (23%) Euros (10%) and as oil (from 8.5 to 10.5 barrels of oil for an ounce of gold).

Now to let you in on a US Gubment secret - well not much of a secret (where to hide a pebble, but ona beach ?) but way back on March 23, 2006, the Board of Governors of the US Federal Reserve System announced that they .....

Now SEA says , " Inflation (which you might estimate as being the relationship of the number of dollars in circulation compared with the value of available goods and services) is commonly thought of as having something to do with Gross Domestic Product versus cash money in circulation". i.e GDP (Growth of )M1 = inflation." will cease publication of the M3 monetary aggregate. The Board will also cease publishing the following components: large-denomination time deposits, repurchase agreements (RPs), and Eurodollars. The Board will continue to publish institutional money market mutual funds as a memorandum item in this release.......

...... M3 does not appear to convey any additional information about economic activity that is not already embodied in M2 and has not played a role in the monetary policy process for many years. Consequently, the Board judged that the costs of collecting the underlying data and publishing M3 outweigh the benefits."

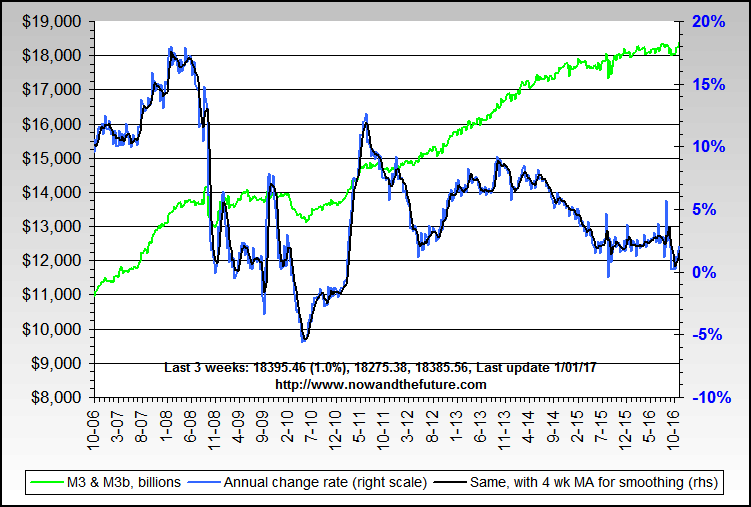

Which of course it doesn't, because it relates to all effective money in circulation - M3 - which is the broadest measure of money supply in the U.S. It includes coins, currency, checking accounts, money market funds, time deposits and institutional money market accounts.If the Fed no longer publish it we rely on (say Bart over at Financial Sense University) who has calculated M3 - and again here at (Now and Futures)

The above is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such.

So M3 inflation is running as of today in excess of 11% - now does that agree with your personal circumstance ? Energy / Food / Fuel / ? ... no wonder the Fed wants to hide the M3 figures..... "is an evident and growing disconnect between what people are told the rate of inflation is, and what they experience in their own lives "(Tim Iacano)- and not just for energy. Healthcare, tuition, and many other service categories have been rising sharply in the US.

"the costs of collecting the underlying data and publishing M3 outweigh the benefits" ... yet Bart can do it (see the site for how it's done) and the Fed have square miles of bright economists, statisticians and other ne'er do wells littering their payroll. The cost ? When they pay our US$20 Bn a year in interest on Treasury Bills ?

Dr. Mark Skousen, Chairman, Dec.8th Investment U tells of having lunch (see pic) with the 93 year old Milton Friedman, and still very alert and knowledgeable about current geo-politics.This is what old MIlt said ..."“I don’t know why the Federal Reserve discontinued the M3 chart,” he said. “But inflation is clearly a problem right now.”

The Prudent Investor has published the corresponsence (originally in WSJ online) between Senator Jim Bunning who asked (the new) Fed Chairman Bernanke why M3 was no longer published - who persists that it is merely a cost saving exercise.

This elementary housekeeping is however watched with great care in Europe , because the European & Asian Reserve banks take considerable notice of M3.

SEA sees this (as do many others - follow the links - have strong coffee handy) as the Big Con. The Fed knows money supply is out of control so we won't re-define it, we'll just ditch the component which everyone has found handy to use and rely ojn the funny money component - as SEA calls it "the real estate boyz and derivatives players weren't making money all day hand over fist through the process of loan creation. A splendid damn miracle. And government - having hidden M3 where it can't see daylight can argue "Ain't no measure of digidollar inflation...that's all speculative."

If you live in the US ... the only thing you will buy cheaper in a year's time is your house.

If you live in the UK ...expect interest rates 1/4% to rise when the Monetary Committee meet 2nd Thursday in Janaury... highest ever under Gordie as bhe battles soaring inflation which new energy bills which have been capped for many wil flutter through the letter box.

Glossary

The M3 "Grease Gun" (more formally United States Submachine Gun, Cal. .45, M3/M3A1) was a WW2 sub machine gun developed by the US as a cheap substitute for the THompson or "Tommy Gun". It was nicknamed the Grease Gun because of its resemblance to an automotive grease gun. Absolutely nothing to do with The Fed's M3. EXcept that it is no longer in use.

2 comments:

cf.

http://en.wikipedia.org/wiki/Nickel_%28United_States_coin%29#Metal_value

http://www.dailykos.com/story/2007/12/26/13438/444/850/426284

Daily Kos shows a stunning stat of M2 + M3 available up to 2005 (good/relevant/recent article), scary to think how this increase must have ripped right up into the sky just over the last 3-4 months alone.

Ekk

Post a Comment