Gerald 6th Duke of Westminster, is not only drunken old fucking lecher, but he is unbelievably thick and stupid - ideal guy for the Army Top Brass

It was not Lord Patel' s intention to mislead readers but due to a failure of the research staff we omitted vital details of the career of the drunken, whoring, raddled Gerald, 6th Duke of Westminster.

It was not Lord Patel' s intention to mislead readers but due to a failure of the research staff we omitted vital details of the career of the drunken, whoring, raddled Gerald, 6th Duke of Westminster.

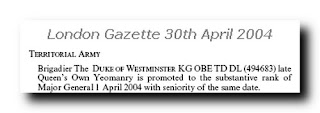

The Duke is evidently an Old Harrovian where he joined the top ranks of academic scholarship by gaining 1 "O" Level (subject unknown) and also failed to obtain entrance to Sandhurst - which even Prince Harry managed. Evidently ideal qualifications for Assistant Chief of Defence Staff (Reserves and Cadets) he did however get pretty snappy promotion- see London Gazette.

After the exposure of his multicultural (and early morning****) whoring the Duke resigned as Chairman of Grosevnor estates and very, very, very, very quietly the MOD replaced him as Assistant Chief of Defence Staff (Reserves and Cadets) with Major General (Rtd.,) Simon Lalor, Honourable Artillery Company- who is also Commercial Director, Britam Defence Ltd, 3rd Floor Marvic House, Bishop's Road, London ,SW6 7AD

Curiously enough this company hove into sight in a very recent posting Saturday, January 05, 2008.... "Chairman of Britam Ltd., Sir Michael Wilkes KCB, CBE who served in the British Army for 35 years reaching the rank of a 4 star General - including Director of Special Forces. On leaving the Army in 1995, he was appointed Governor and Commander in Chief of the Island of Jersey where he served until 2000. (and would of course have a great deal to do with Bailiff of Jersey , SIR PHILIP MARTIN BAILHACHE , QC who was elected to the post in 1989.) Since that time he has become Deputy Chairman and Senior Independent Non-Executive Director of C. I. Traders Limited, a broadly based property and retail company which is the largest employer in the Channel Islands. He takes an interest in the finance industry and is Chairman of Chiltern Holdings (Jersey) Ltd. He maintains his interest in Middle Eastern affairs through his Chairmanship of Britam Defence Ltd. "..a special force in the oil and gas industry." To those who are interested in this sort of thing this website is the sort of website they will find..er..interesting.

Odd how Jersey and it's many magnificent offices keep cropping up in polite conversation - people who love dressing up in mediaeval costumes ......

**** Old adage of the landed classes - "Never roger the wife first thing in the morning - somethin' better's bound to crop up durin' the day"

**** Apologies again for the shortage of facts - corrective punishment will be applied to the staff, proportionate, rigorous and discreet.

Of course if anyone out there knows more about C.I. Traders the biggest employers in the CI , who must necessarily liase closely with providers of care for children to help establish them in a working life...... children who must be very grateful.

Fascinating little biography of Gerald in the Manchester Evening News 27/ 5/2005

"When you are born with a silver spoon in your mouth, it's good to take it out every so often," explains Gerald Cavendish Grosvenor, the sixth Duke of Westminster and the wealthiest individual in the M.E.N. Rich List (Now was he just talking about his spoon ?) . Apparently he"earned" £240 a day as head of TA and his godchildren Princes Harry and Edward were ushers at the wedding of his daughter , Lady Tamara, which their father was kept away from.

2 comments:

I don't know if Sir Michael Wilkes' company, Chiltern Holdings (Jersey) Ltd is in any way connected to WJB Chiltern Trust Company (Jersey) Ltd. but they both appear to be at the same address, 38 Esplanade, St Helier, Jersey. WJB Chiltern Trust Company (Jersey) Ltd was a major shareholder in Amitel Holdings Ltd Amitel Holdings was a major shareholder in Amitel Ltd. In Optigen Ltd and the Commissioners of Customs & Excise and Fulcrum Trading Co (UK) Ltd and the Commissioners of Customs & Excise one of the companies involved in the carousel fraud was Amitel Ltd.

CI Traders was bought by TOM SCOTT, a Freemason who moved to Guernsey, in the Channel Islands, on the sale of their substantial UK business.

His brother, TIM SCOTT, who, in turn, moved to Jersey [in St Brelade - the same parish where Frank Walker - another Freemason lives] runs an international Biogas Technology Company based in Sawtry, Cambridgeshire.

[In comparison, the Chief Minister of Jersey - Frank Walker - is he not very well known now for all his dissembling and deceit? lives in St Brelade - he is a prominent Freemason - and Frank Walker specialises in building property where no other person would be allowed planning permission, done through his Isle of Man Dandara "offshore" untransparent unaccountable property development company - so he is not challenged about all the ugly properties going up around Jersey and blighting its landscape].

CI Traders is owned by Tom Scott.

SALE OF C.I. TRADERS GOT THE GREEN LIGHT. [Through his Freemason pals in Jersey].

The Channel Islands’ largest company, C.I. Traders, has been sold for a reported £260 million, subject to shareholder and regulatory approval.

C.I. Traders includes some of the largest supermarkets in the islands, including Checkers, the Marks & Spencer franchise in Jersey, Benest’s and Safeway, as well as pubs, hotels in Guernsey, and a large distribution and wholesale operation. The deal that was first announced in October last year also includes the sale of a number of properties to current chairman TOM SCOTT, which are said to be worth £70 million.

These include 27 sites in Guernsey and 18 in Jersey, including Marks & Spencer in King Street and St Clement, the former Cosmopolitan on the Esplanade, the Southampton Hotel and many more. In some cases the properties will be leased back to the company.

Buying C.I. Traders is private equity consortium Sandpiper Bidco Ltd, comprising Duke Street Capital, an independent private equity firm; Europa Capital, a real estate fund management group; and Uberior Co-Investments Ltd (UCIL), a wholly-owned subsidiary of banking group HBOS and aminor investor in the scheme.

A statement on the London Stock Exchange said: “Sandpiper has given assurances to the board that, following the scheme becoming effective, the existing contractual employment rights including pension rights of all employees of the group (except those being transferred to the companies owned by TOM SCOTT or their subsidiaries) will be maintained.”

A number of conditions have to be met before the offer can be completed. Shareholder approval will be required, which must be sanctioned by the Royal Court of Jersey, and Jersey Competition and Regulatory Authority approval must also be given.

If any of these or a number of less significant conditions are not met, the proposal will not proceed and C.I. Traders and its businesses will continue to be managed as the board had intended prior to this approach being received.

“Once the conditions have all been met (including approval by the Royal Court of Jersey - also controlled by Freemasons), the entire share capital of the company will be transferred, whether or not individual shareholders vote to accept or reject the proposal,” said C.I. Traders’ chief executive Martin Bralsford in a letter to shareholders.

“In the documents constituting the proposal, they [Sandpiper Bidco Ltd] have also given undertakings regarding the continuation of the company’s head office in Jersey and as regards the rights of current employees and pension fund members. On the proposal being completed, your current board will step down to allow new senior management to take control of the business as a private company.

”The offer for C.I. Traders is in the form of a scheme of arrangement, which requires 75 per cent shareholder approval. A simple offer would have required 90percent. Now it is for shareholders to decide whether or not they want to back that acquisition, paying out £1 per share. If two-thirds agree, the scheme will go before the Royal Court on August 2.

JERSEY FACES “SERIOUS PROBLEMS”, SAYS ECONOMY ADVISER David Kern, the Economic Adviser to the British Chamber of Commerce, warns that the island could face serious problems in the financial services industry. In a report commissioned by Jersey’s Chamber of Commerce, Kern says that introducing GST and reducing corporate tax are the correct strategic responses if Jersey is to safeguard its key industry: financial services.“

In recent months there has been worrying slippage in Jersey’s budgetary position,” said Kern. “The competitive advantages that have underpinned Jersey’s recent successes are likely to face serious challenges. The obstacles to growth have also become more pronounced, particularly in the financial sector.

It is important to reverse these adverse trends. Diversity is attractive in principle, but should never be used as an excuse for squeezing the financial sector, which will remain Jersey’s main wealth creator.

Indeed, removing obstacles currently facing the financial sector (in making it easier to import skills and ensure local people become UNEMPLOYED in speeding up law drafting so that local people do not get the opportunity to object to unaccountable untransparent proposed legislation) are urgent policy priorities.”

Another nail in the coffin for Jersey and Jersey people!

Post a Comment