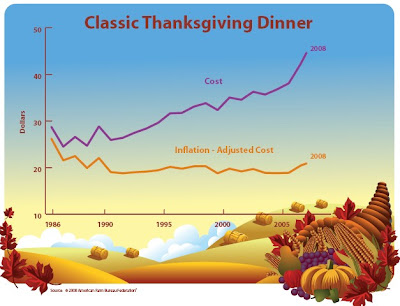

Thanksgiving. Costs up 9% and food producers do really rather well despite higher costs

The American Farm Bureau's 23rd annual informal price survey of classic items found on the Thanksgiving Day dinner table indicates the average cost of this year’s feast for 10 is $44.61, a $2.35 price increase from last year’s average of $42.26.

Turkey prices are up 8%. Rolls, cranberries, sweet potatoes and even pumpkin pie are more expensive.

The cost of a 16-pound turkey, at $19.09 or roughly $1.19 per pound, reflects an increase of 9 cents per pound, or a total of $1.46 per turkey compared to 2007.

This 6% increase in national average cost reported this year by Farm Bureau for a classic Thanksgiving dinner tracks closely with their quarterly marketbasket food surveys and the federal government’s Consumer Price Index

Higher prices aren't reflected in food producers profits as commodity costs have risen faster than the prices consumers pay, resulting in lower gross margins. For example Hormel Foods reported on Tuesday . The company blamed higher feed and fuel costs for hurting margins in its Jennie-O Turkey Store segment. Total fiscal fourth-quarter profits fell to 50 cents per share, from 73 cents.

For example Hormel Foods reported on Tuesday . The company blamed higher feed and fuel costs for hurting margins in its Jennie-O Turkey Store segment. Total fiscal fourth-quarter profits fell to 50 cents per share, from 73 cents.

Earnings were also affected by the company's "rabbi trust", which is a vehicle used to defer executive compensation. The name comes from a specific IRS ruling - the IRS determined that .. an irrevocable trust established for a rabbi by the rabbi's congregation was not subject to current income taxation of the assets therein because the assets remained subject to the claims of the congregation's general creditors. In other words a cunning and "tax efficient" way to reward the fat cats that run the shop - inappropiate maybe for a company famous for its pig products.

That didn't stop the good news for stock holders though ..."The annual dividend on the common stock of the corporation was raised to $.76 per share from $.74 per share. " .. the 322nd consecutive quarterly dividend paid by the company.

"The two-cent increase follows strong sales for many of the company's new products and the strength of many traditional product lines in 2008," said Jeffrey M. Ettinger, chairman of the board, president and chief executive officer, Hormel Foods. "Our focus on innovation continues the drive toward achieving $2 billion in total sales of products created since 2000."

CEO Jeffrey M. Ettinger anticipates "a slow start to fiscal year 2009", but is hopeful that the second half of the year will be stronger. He predicts HRL will earn between $2.15 and $2.25 this fiscal year, which is below the consensus earnings estimate of $2.29 per share. (PE 11.4)

This came after Campbell Soup Company revealed that its gross margins were hurt by higher commodity costs. Gross margins for the company's fiscal first-quarter fell to 40.2%, on an adjusted basis, from 40.8% a year prior. Sales still rose, however, increasing 3% to $2.25 billion - Russia and China represent approximately 50% of their global soup consumption and they are actively preparing to expand their businesses in both markets in fiscal 2009. A slight increase in volume and a 7% improvement in price and sales allowances caused the revenue growth. This, plus fewer shares in issue showed EPS to total 77 cents, 10% higher than a year ago and a cent above expectations. (WSJ July 2007 ) "In China, 320 billion bowls of soup are consumed each year, compared with 32 billion in Russia and just 14 billion in the U.S.”

Sales still rose, however, increasing 3% to $2.25 billion - Russia and China represent approximately 50% of their global soup consumption and they are actively preparing to expand their businesses in both markets in fiscal 2009. A slight increase in volume and a 7% improvement in price and sales allowances caused the revenue growth. This, plus fewer shares in issue showed EPS to total 77 cents, 10% higher than a year ago and a cent above expectations. (WSJ July 2007 ) "In China, 320 billion bowls of soup are consumed each year, compared with 32 billion in Russia and just 14 billion in the U.S.”

See IHT story July 2008 about Campbell's sales successes in China and Russia...."In Russia, the company said, 70 % of the people who try Campbell products buy them again."

The really, really bad news is that commodity price hikes meant Gross margins for the company's fiscal first-quarter fell to 40.2%, on an adjusted basis, from 40.8% a year prior. (PE 10.43)

No comments:

Post a Comment