Postman Patel returns like a dog to his vomit - smug bastard

Postman Patel Wednesday, January 03, 2007 The Mysterious case of the disappearing M3 is worth re-reading. Containing as it does Your New Year Cut out 'N' Keep New year supplement for 2007".

It also contained the laughable quote ...

"If you live in the US ... the only thing you will buy cheaper in a year's time is your house."

Daily Telegraph today , "House prices in US fall at record rate"

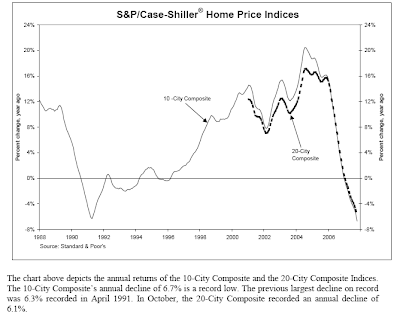

"The Standard & Poor's/Case-Shiller index through October (i.e not yet including Nov/Dec) of 10 metropolitan areas fell 6.7pc compared to October 2006, a record decline. The previous biggest fall was a 6.3pc drop recorded in April 1991 just after the recession of the early 1990s." ...." The index has fallen every month in 2007 ... etc., etc., "

..and the grisly details ..

Click images to enlarge ...

Miami being the high (that is low) spot you might like to look at this on record Miami foreclosures and this from the NYT about cut price luxury condos in Palm Beach.

Pic by Documentary photographer Dorothea Lange b.1895 - d. 1965 from the Depression in the Dust Bowl. "Photography takes an instant out of time, altering life by holding it still."

4 comments:

http://www.dailykos.com/story/2007/12/26/13438/444/850/426284

Daily Kos article 'Credit Crunch vs. Central Banks - You Lose' has M2 + M3 graph up to 2005.

Stunning to think how much more that money supply has been has increased just over the last 3-4 months alone.

Interesting questions posed by on of the comments on Kos: There has never been inflation with/while house prises have not gone up also.

So what's going to happen here, lot & lots more money created out of thin air inflating the money supply, seeking investment opportunities goods/houses to buy?

Ekk

THere is in theory an infinite supply of goods like gas, power, food, clothes but not land for houses. so different conditions apply.

Not sure if I get that, sorry?

Theoretically, with another 1/2trillion US Dollars and 1/2 trillion additional Euros/pound of liquidity/credit being thrown into the market, how can/will house prices come down? On the one hand I can't see how there cannot be massive inflation -which usually means house prices rocked up too- yet at the same time/this time house prices are already hyper-high.

Ekk

Um, is this a real Lange 'Migrant Mother' photo, or a retro retouch job of some sort? Just asking, like. I've not seen it before, and it somehow doesn't ring true.

On other matters, I wanted to say a big thank you for all your copious words of analysis this year past. I might not say a lot, but I do read most of all you write.

Looking forward to more of the same in 2008. Keep up the good work!!

(Oh Blogger is annoyingly stopping me from commenting, again, as other than anon. I will put in my own html, and hope it sticks this time.)

Best, B

The Photography Pages

Post a Comment